Download this article as a pdf

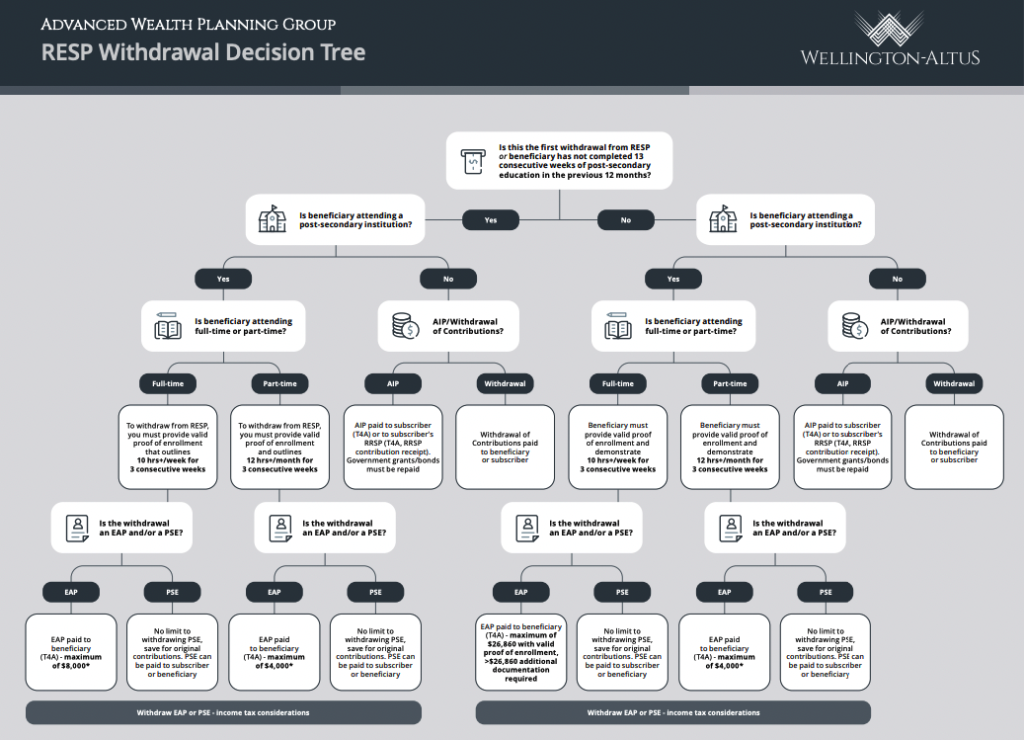

When withdrawing from an RESP, there are a variety of considerations to keep in mind, such as is this the first time the beneficiary is attending post-secondary education, are they attending full or part-time, and what makes the most sense – withdrawing EAP and/or PSE. This RESP decision tree outlines the different withdrawal options available depending upon the students circumstances.

For additional information about maximizing your RESP’s value, please see here.