Discretion is the Better Part of Valour

“We are navigating by the stars under cloudy skies.” – Chairman Jerome H. Powell, August 25, 2023

The adage, “Discretion is the better part of valour,” has never been more pertinent as the U.S. Federal Reserve cautiously navigates between the perils of inflation and deflation. In the world of economic policy, the Federal Reserve finds itself delicately engaged in a balancing act akin to a tightrope walker traversing a starlit sky obscured by clouds. The elusive concept of the “neutral interest rate” remains shrouded in uncertainty, and one could plausibly argue that rate hikes possess an inflationary nature. With continued reliance on outdated economic theories and models, the present quandary should come as no surprise.

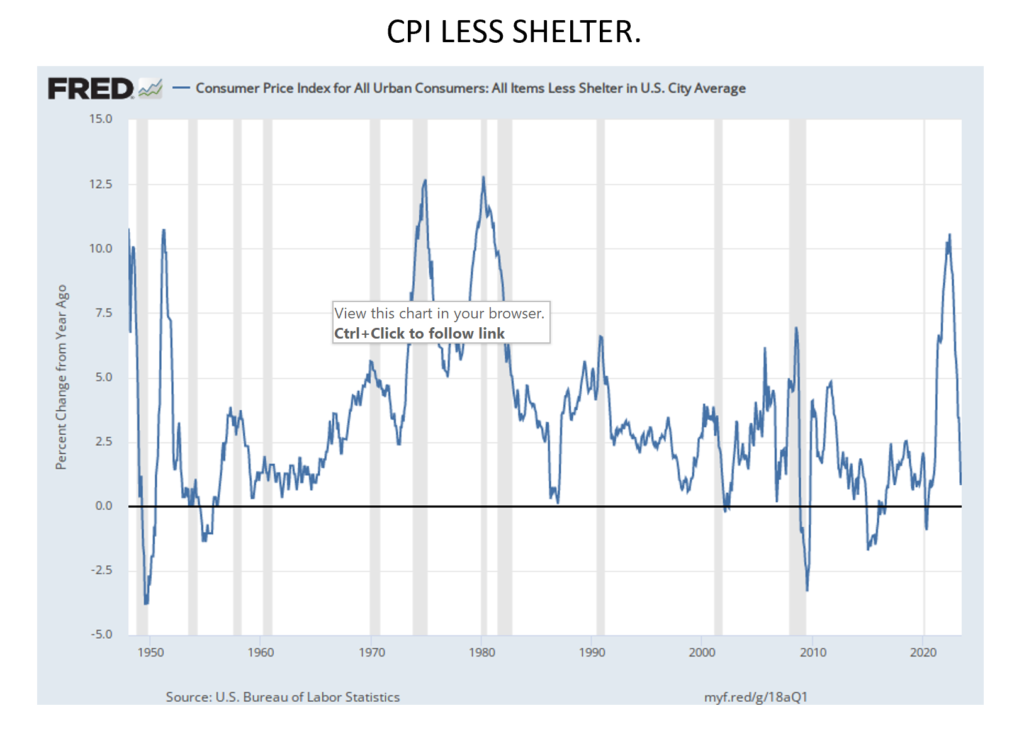

The global economy has weathered two external shocks, resulting in an unprecedented inflationary upheaval. In response, central bankers tightened financial conditions by raising short-term interest rates to levels exceeding 5%. However, before the full ramifications of these rate hikes could materialize, inflation experienced a significant decline. By some metrics, inflation now resides close to the Federal Reserve’s targeted 2% threshold.

This has ignited a spirited debate among experts, with some contending that the rate hikes were misguided while others advocate for further increases. Personally, I maintain the belief that hikes surpassing 2.5% were unnecessary, and the possible rate hikes in 2023 have the potential to culminate in a substantial policy misstep, evoking memories of the debt and deflationary concerns that plagued the aftermaths of the First and Second World Wars.

The recent Jackson Hole Economic Symposium perfectly illustrates this quandary as policymakers grapple with the timing of their actions. Acting too swiftly risks pushing the economy into deflation and a recession. On the other hand, delaying action may allow inflation to spiral out of control.

The highly anticipated speeches by U.S. Federal Reserve Chair Jerome Powell and European Central Bank (ECB) President Christine Lagarde marked a nuanced yet significant shift from a sole focus on inflation to an acknowledgment of the deflationary and recessionary risks associated with overtightening. This nuanced perspective reflects the Federal Reserve’s delicate balancing act as it seeks to navigate the economic landscape with precision and foresight.

Moreover, Austan Goolsbee, President of the Federal Reserve Bank of Chicago, foresees a “Golden Path” to deflate inflation without sparking a recession. We are now witnessing the end of the most aggressive tightening cycle in modern history. However, if history serves as a guide, the consensus that “This time is different” may be misguided. In a world rife with uncertainty, investors require clarity, flexibility, and humility. They must cultivate a forward-looking vision, a task that is becoming ever more challenging in an environment marked by frequent exogenous shocks, a rise of populism, the emergence of new technologies, and an increasingly interconnected world. Yet, if we look at history, the risk of a deflationary episode of secular stagnation, like the aftermaths of the First and Second World Wars, should not be overlooked by policymakers and investors. As the old saying goes, “This time, it’s not different.”

Therefore, it is crucial to consider historical patterns and lessons as we navigate these uncertain times. Policymakers at Jackson Hole (like Powell and Lagarde) gave many clues, yet, as usual, most were ignored. The consensus is their speeches were hawkish. I disagree. Both speeches were balanced and hinted that they understand the risks are now symmetric, balanced between inflation and deflation. We provide some much-needed context.

An End to the Rate-Hiking Cycle

At the recent Jackson Hole Economic Symposium, Federal Reserve Chair Jerome Powell acknowledged the strides made in taming inflation but cautioned that we are not out of the woods yet. He underscored the need for vigilance until inflation is tamed to the 2% target. Simultaneously, he warned against the perils of overzealous monetary policy, which could thrust us into a recession. Powell’s nuanced speech hinted at a higher threshold for continued rate hikes, suggesting that the risks are now evenly poised between inflation and deflation.

The market’s obsession with the inflation-ridden 1970s blinds it to the potential for a debt/deflation crisis, reminiscent of Irving Fisher’s analysis of the Great Depression. Overtightening in a global economy with extreme debt levels creates a post-First and Second World War deflation-recession scenario.

Powell’s speech hinted at an upcoming pause in rate hikes, suggesting that the Federal Reserve’s objectives are increasingly within grasp. This cautious approach – a recognition that the policy rate is in restrictive territory – coupled with a pause to evaluate, signals a data-dependent stance, with the Fed keeping a close eye on economic indicators before making further policy decisions. It’s a very good sign.

The speech did not slam the door shut on rate hikes, but it did lay the groundwork for a potential “mission accomplished” speech in November. This announcement will offer more explicit guidance on the Federal Reserve’s future policy actions and the trajectory of interest rates. The glide path of inflation back to its 2% target is unknown, however, with the foundational forces of deflation strengthening, we cannot rule out a deflationary shock in 2024. Japan’s lessons from the 1990s are being ignored. How quickly we forget the concern about the inability to achieve the 2% inflation target in the pre-COVID-19 world. True, many proclaim that we are in a new inflationary era, but history does not support such bravado-induced proclamations by many on Wall Street.

Powell’s speech came at a time of escalating global market uncertainties, including trade tensions, geopolitical risks, and emerging market vulnerabilities. Some interpret the Federal Reserve’s cautious stance as a response to this challenging backdrop, given its efforts to maintain stability and foster economic growth.

Over the past two years, the Federal Reserve’s communication strategy has been hawkish, aiming to shape inflation expectations. However, Powell’s speech hints at a potential end to the rate-hiking cycle. Despite this shift, Wall Street and market participants often interpret the Federal Reserve’s messaging as biased towards continued hawkishness. This tendency stems from their desire for clarity amidst uncertainty.

The challenge for Powell lies in effectively communicating the central bank’s intentions to Wall Street and the broader market. Even if the last rate hike has already happened, Powell must convey that the Federal Reserve’s stance is evolving towards a more accommodative position. Without explicit communication, the assumption of continued hawkishness may persist. The Federal Reserve is on the brink of pulling off a soft landing, and it’s high time the market took notice.

Christine Lagarde: “Life Can Only Be Understood Backwards, but it Must Be Lived Forwards”

To encapsulate policymakers’ conundrum, ECB President Christine Lagarde’s speech at Jackson Hole invoked philosopher Søren Kierkegaard’s famous quote, “Life can only be understood backwards, but it must be lived forwards.” They must anticipate the future and act accordingly, even though the true impact of their decisions will only be understood in hindsight.

Lagarde identified three significant shifts in the current environment: 1) the escalating frequency and severity of global energy supply shocks, 2) a deepening geopolitical divide and fragmenting global economy, and 3) the rise of new technologies and their impact on the nature of work. These shifts could transform the nature of the shocks we face and their economic impact. Policymaking in this context demands clarity about policy goals and trade-offs, flexibility to adapt to new information and changing circumstances, and humility to recognize the limits of our knowledge and the potential for unintended consequences. Lagarde’s speech did not receive the attention it deserved and may have contained clues indicating policymakers are about to shift focus and take a more holistic, forward approach.

Lurking in the Shadows are Significant Risks that Remain Unaddressed

China’s economic challenges, including rising debt levels and the risk of deflation, pose significant threats to global economic stability. The end of China’s growth miracle has shocked investors and policymakers worldwide and could trigger a national deflationary spiral that would reverberate through global trade and financial markets. However, it is important to recognize that China has entered a new era that is as transformative as its accession to the World Trade Organization decades ago.

Henry Kissinger’s book “On China” cautions against evaluating China’s strategic policies through a Western lens. Chinese President Xi Jinping has philosophical objections to Western-style, consumption-driven growth, viewing it as wasteful and counterproductive to his goal of transforming China into a leading industrial and technological power. Xi advocates for fiscal discipline, making stimulus or welfare policies similar to those in the U.S. and Europe less likely. This new era presents both challenges and opportunities for the global economy, and it is important that investors and policymakers carefully navigate this evolving landscape. Notably, Powell did not mention this topic as a risk in his Jackson Hole speech, raising the question of why the Federal Reserve is not more concerned about the potential impact of China’s economic challenges on the global economy. The ongoing debt crisis is not isolated to China. Several regions, including Canada, Europe and other parts of Asia, are wrestling with an overreliance on the property sector, vulnerable banks burdened by high levels of non-performing loans, and weak capital buffers. The potential domino effect of a banking crisis in any of these regions could exacerbate global financial instability.

The commercial real estate market also poses a potential risk. The prolonged low-interest-rate environment has sparked a frenzy in commercial real estate investments, leading to inflated property values and soaring debt levels. With financial conditions already restrictive, commercial real estate could face a harsh correction, potentially triggering a broader financial crisis.

The common thread in all these unaddressed risks is the potential for deflation. Deflation, characterized by a sustained price decline, can wreak havoc on economic growth and financial stability, leading to reduced consumer spending, increased debt burdens, and downward pressure on wages and profits.

What Should Investors Do?

In conclusion, the economic landscape is a complex tapestry woven by policymakers like Christine Lagarde and Jerome Powell. Their insights into the future of interest rates are invaluable, but vigilance and proactive monitoring of these developments are paramount to mitigating potential risks and fortifying economic resilience. As for investors, strategically constructing a high-quality, balanced portfolio of stocks and bonds to navigate the potential headwinds of slow growth, disinflation, and declining rates is recommended. I favour the belly of the yield curve for bonds and companies poised for an investment led innovative era for stocks.

However, we must not overlook the looming shadow of extreme debt levels and the possibility that central banks have over-tightened. The euphoria from the war-like fiscal policy, akin to a sugar high, is bound to dissipate. The impending shock from a potential debt/deflation episode in China, a generational event, remains largely unaccounted for. Companies and economies that thrived on China’s debt-fuelled urbanization boom are now on shaky ground.

The famous proverb, “Discretion is the better part of valour,” rings especially true in today’s economic climate. Investors must navigate this high-wire act with precision, balancing the risks of inflation and deflation to safeguard the long-term health and stability of their portfolios.

Contrary to the consensus, I posit that deflation is a significant risk. Current growth, largely fuelled by extreme debt, is more a fleeting sugar rush than a sustainable trajectory. As the high wears off, and as we witness a slowdown in China’s growth reminiscent of Japan in the 1990s, the risk of a slow-growth deflationary scare looms large. This could dramatically alter the prevailing narrative of persistent inflation, leading to substantial rate cuts and a potential divergence from the so-called “Golden Path” of Mr. Goolsbee.

The stakes are high, and the dance between inflation and deflation continues. As the dust settles, we propose that a slow-growth deflationary environment is a risk that investors must brace for. The economic future may be uncertain, but with vigilance, strategic planning, and a willingness to challenge consensus, we can navigate the storm and emerge stronger on the other side.