When it comes to philanthropy, Canadians today are more intentional, want to see the impact of their gift, and are giving more. With intentional philanthropy, clients should address the following questions:

- When do they wish to give?

Today, next year, or in their Will? - How do they wish to give? Through a one-time donation, a regular monthly/ annual donation, or by naming the charity as a beneficiary on a particular account or life insurance policy?

- Who should give? An individual, a family corporation or trust?

- How should the gift be funded? Through cash, donations in-kind of securities, ecologically sensitive land or cultural property?

Consider this scenario:

Marija and Steve were grateful that their business had done well over the last two decades and their children were independent. They reached out as they were interested in making a $25,000 donation to a charity that they, and their families, had benefited from over the years. They requested $25,000 be withdrawn from their non-registered investment account and deposited into their chequing account.

What should Marija and Steve consider in maximizing their donation, and the benefit of such?

If they decide to make their donation personally, they could fund it with cash, by selling securities from their non-registered account, or by donating shares in-kind.

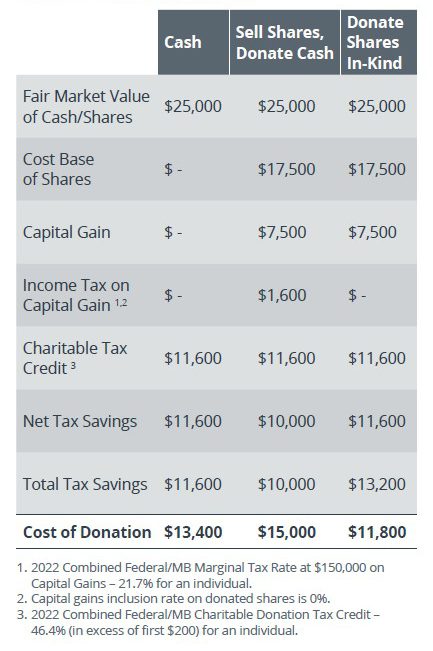

Here is a summary of the tax reporting or overall cost of making the donation these three ways:

Personal Donation Options:

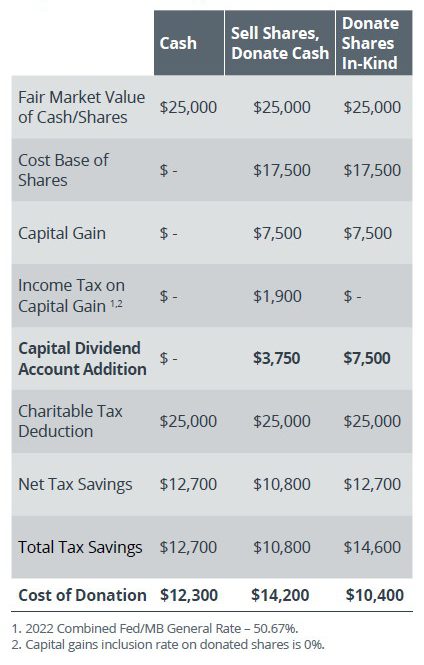

Marija and Steve also have a successful business corporation with a non-registered account and wonder if it would be more tax-efficient for the corporation to make the donation. What matters most is that the donation is made. Here is a breakdown of the tax reporting or overall cost to the corporation of making the donation:

Corporate Donation Options:

There are two notable distinctions to highlight when a corporation funds a donation, namely:

- a donation is a tax deduction to a corporation as opposed to a tax credit for an individual; and

- the tax-free portion of any capital gain is added to the corporation’s Capital Dividend Account, which allows a tax-free dividend to be declared and paid out to the corporation’s shareholders.

Looking at the above three scenarios, the preferred method again would be to donate shares with a fair market value of $25,000. Marija and Steve’s corporation pays no tax on the capital gain and the corporation receives the same charitable tax credit as they would have received by donating $25,000 cash. The corporation can then pay out $7,500 to Marija and Steve tax free given the Capital Dividend Account increase.

As highlighted, there are many factors to consider when contemplating a charitable donation. Please reach out to your Wellington-Altus advisor to discuss further.

RALPH WALDO EMERSON