En matière de philanthropie, les Canadiens sont de nos jours plus délibérés, plus soucieux de l’impact de leur don et plus généreux. Les clients pour qui la philanthropie est importante devraient se poser les questions suivantes:

- Quand veulent-ils faire un don?

Aujourd’hui, l’an prochain, ou dans leur testament? - Quel genre de don veulent-ils faire? En versant un don ponctuel, des dons mensuels ou annuels réguliers ou en désignant l’organisme de bienfaisance comme bénéficiaire d’un certain compte ou contrat d’assurance vie?

- Qui devrait faire le don? Un particulier, une société ou fiducie familiale?

- Comment le don devrait-il être financé? Au moyen d’espèces, de dons en nature de titres, de terres écosensibles ou de biens culturels?

Considérez le scénario suivant:

Marija et Steve se réjouissent d’avoir vu leur entreprise prospérer au cours des vingt dernières années et assuré l’indépendance de leurs enfants. Ils ont communiqué avec nous parce qu’ils souhaitaient faire un don de 25 000 $ à un organisme de bienfaisance qui avait aidé leur famille au fil des ans. Ils ont demandé que 25 000 $ soient retirés de leur compte de placement non enregistré et déposés dans leur compte de chèques.

Quels aspects devraient-ils considérer pour maximiser leur don et les avantages qui en découlent?

S’ils décident de faire un don personnel, ils pourraient se servir d’espèces, vendre des titres de leur compte non enregistré ou donner des actions en nature.

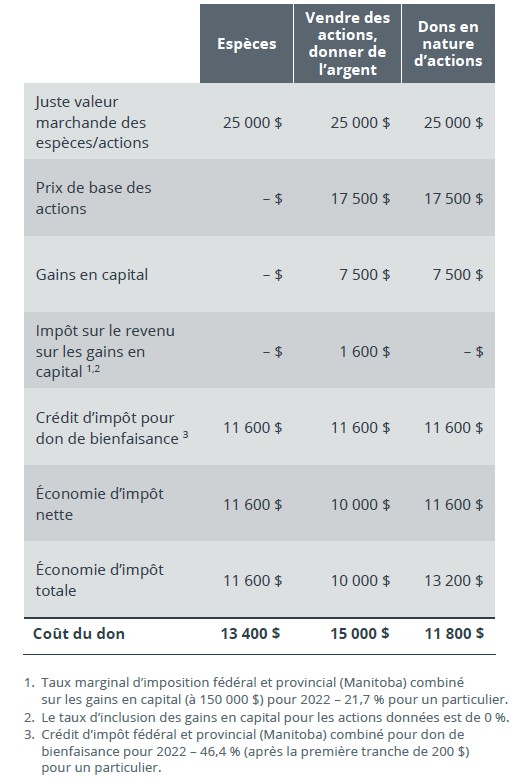

Voici un résumé des trois façons dont ce don peut être fait compte tenu du traitement fiscal et du coût global:

Options de don pour un particulier:

Marija et Steve ont aussi une société par actions prospère détenant un compte non enregistré et se demandent s’il y a un avantage fiscal à ce que la société verse le don. Le plus important, c’est de faire le don. Voici une ventilation du traitement fiscal et du coût global du don pour la société:

Options de don pour une société:

Il faut souligner deux distinctions importantes lorsqu’une société finance un don, à savoir:

- un don est une déduction d’impôt pour unesociété par opposition à un crédit d’impôtpour un particulier;

- la partie non imposable de tout gain en capitalest ajoutée au compte de dividendes en capitalde la société, ce qui permet de déclarer undividende libre d’impôt et de le verser auxactionnaires de la société.

Selon les trois scénarios ci-dessus, il serait encore une fois plus avantageux de faire un don d’actions dont la juste valeur marchande est de 25 000 $. La société de Marija et Steve ne paie pas d’impôt sur les gains en capital et la société reçoit le même crédit d’impôt pour don de bienfaisance que si elle avait fait un don de 25 000 $ en espèces. La société peut alors verser 7 500 $ à Marija et à Steve en franchise d’impôt compte tenu de l’augmentation du compte de dividendes en capital.

Ces exemples illustrent bien les nombreux facteurs qui doivent être pris en considération au moment d’envisager un don de bienfaisance. Veuillez communiquer avec votre conseiller Wellington-Altus pour en discuter davantage.

RALPH WALDO EMERSON