A Glimpse Into The Future Of Financial Markets From 2024 To 2030

In early 2021, I presented a thesis regarding the latest inflation episode and its potential economic implications. At that time, I shared a perspective that differed from the prevailing narrative. Allow me to recapitulate my viewpoint.

I argued that the inflationary period we were experiencing was more akin to the post-Second World War era than the environment of the 1970s. The twin shocks of the COVID-19 pandemic and the war in Europe had occurred almost simultaneously, creating an illusion that inflation was spiralling out of control. However, I emphasized that throughout this period, inflationary expectations remained well-anchored.

Contrary to the prevailing belief, rate hikes could lead to inflation. I supported this claim with evidence from Statistics Canada (StatCan), which indicated that rate hikes may not necessarily accelerate the adjustment process. Instead, I suggested they could have unintended consequences, such as slowing economic growth, early signs of a credit crunch, and increased deflationary forces.

In my thesis, I highlighted that rapid cuts in interest rates might be necessary to counteract the potential deflationary forces and stimulate economic growth. I argued that central bankers had made a critical mistake by assuming that deflation was a thing of the past, failing to learn from historical lessons.

The United States economy has been on a rollercoaster ride in recent years, with unprecedented challenges posed by the COVID-19 pandemic. As the nation gradually recovers, experts closely monitor the Federal Reserve’s tightening policies to gauge the potential impact on the economy. My view remains that there will be a “soft landing” and the potential for the S&P 500 to reach 5,400 by the end of 2024. This highlights the interplay between the U.S. Federal Reserve’s actions and the overall economic trajectory.

Understanding a “Soft Landing”

A “soft landing” refers to a scenario where the economy transitions smoothly from a period of expansion to more sustainable growth, avoiding a recession or overheating. Achieving a soft landing requires careful calibration of monetary policies, particularly those implemented by the Federal Reserve. Historically, the Fed has faced challenges in striking the right balance, often leading to economic volatility. However, if it does not continue to tighten excessively, it is possible to achieve a soft landing for the U.S. economy. Unfortunately, the same cannot be said for Canada.

Canada’s Economic Challenges: Lack of Diversification and High Debt Levels

Canada’s economy faces unique challenges that may hinder its ability to achieve a soft landing and maintain economic resilience. One significant challenge is the need for more diversification. While the U.S. economy is known for its varied industries, Canada relies heavily on sectors such as natural resources, particularly oil and gas. This lack of diversification leaves it vulnerable to fluctuations in global commodity prices, making it more challenging to navigate economic downturns.

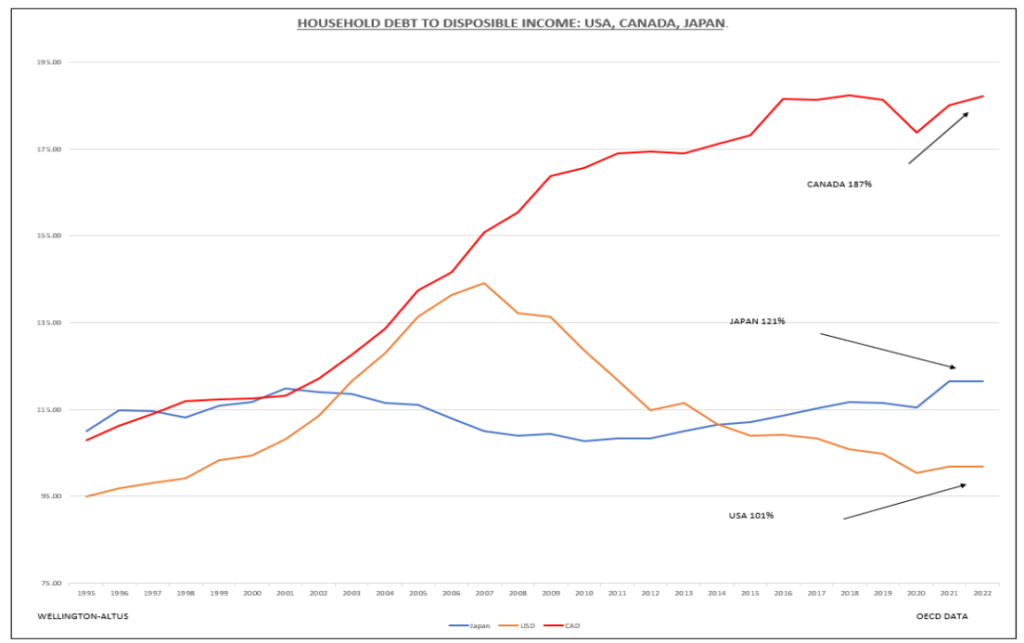

Another concern is the high levels of debt in Canada. Household debt has reached record levels, raising concerns about financial stability during an economic downturn. Excessive debt can constrain consumer spending, reduce investment, and hinder economic growth. Managing and reducing debt levels will be crucial for Canada to achieve a soft landing and build resilience.

Moreover, Canada’s heavy reliance on the real estate sector further risks its economic stability. A significant portion of the country’s wealth is tied to real estate, and any significant downturn in the housing market can have far-reaching consequences. A lack of diversification beyond real estate could impact Canada’s economic resilience, making it more susceptible to shocks in the housing market.

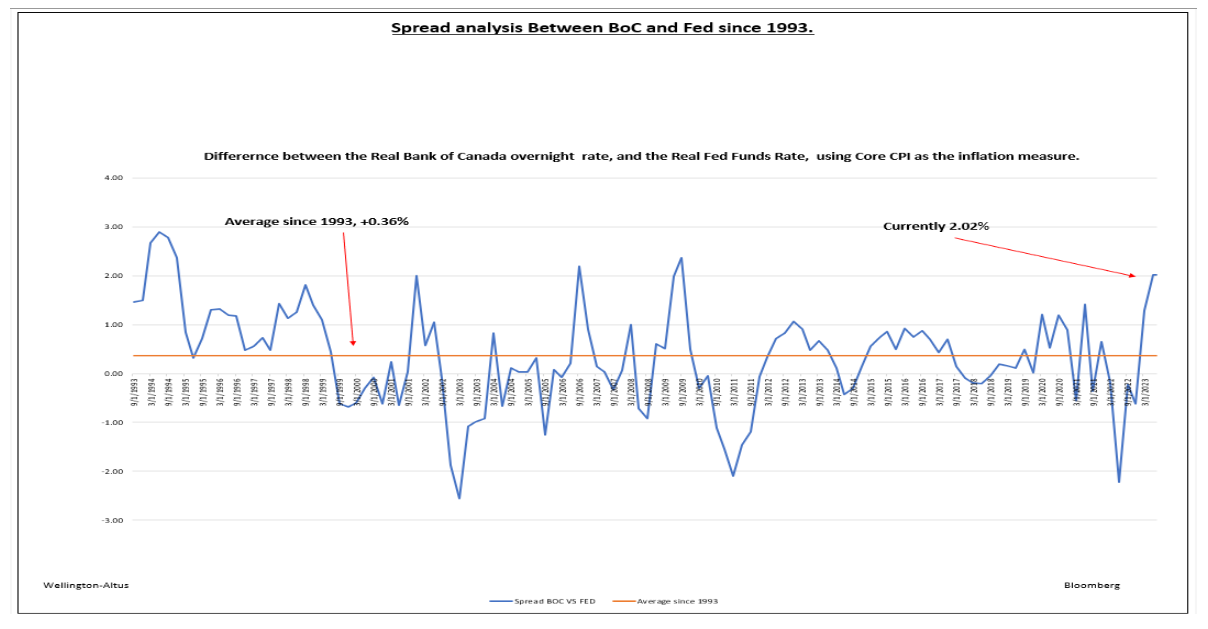

However, a strategic approach to managing these challenges, including addressing debt levels, fostering innovation, and effectively managing immigration policies, can support economic growth and enhance resilience. Navigating the road to economic stability requires careful consideration and prudent policymaking and investment strategies. With household debt to disposable income at 187% and the Bank of Canada tighter than the Federal Reserve, a soft landing in Canada is not a distinct possibility.

The U.S. Federal Reserve and the Bank of Canada’s Role

The Federal Reserve plays a crucial role in managing the nation’s monetary policy, making it a key determinant of economic stability. As the economy recovers from the pandemic-induced downturn, the Fed primarily focuses on stimulating growth and managing inflationary pressures. However, as the recovery progresses, concerns about inflation have prompted discussions about tightening monetary policy.

The fears communicated by the Bank of Canada about the risk of the economy overheating related to accelerating inflation are misplaced. A closer examination of critical data reveals the situation may not be as dire as perceived. Excluding the effects of the Bank of Canada’s rate hikes, which have contributed to 30% of the Consumer Price Index (CPI), Canada currently stands at 2% – aligning with the midpoint of their legislative target range.

Inflation is under control, eliminating one of the primary concerns of an overheating economy. Furthermore, analyzing the historical patterns of inflation, it becomes evident that additional exogenous shocks caused second spikes in the 1950s and 1970s, the outbreak of the Korean War and the Iran Revolution, rather than inherent economic factors. Therefore, a delicate balancing act is required to ensure a smooth transition to sustainable growth.

The Path to Economic Resilience

Several factors must align to achieve a soft landing. First and foremost, the Federal Reserve must adopt a cautious approach to tightening monetary policies, ensuring that the pace is gradual and predictable.

Additionally, continued fiscal stimulus measures and targeted government spending can provide a strong foundation for economic growth. Investments in infrastructure, renewable energy, and technological innovation can enhance productivity and create new job opportunities that drive the economy forward. These measures provide support for economic growth through an adjustment period. However, the extreme debt levels coupled with the high interest rates mean the extent to which fiscal policy can support future economic growth is a big unknown heading into 2024.

A robust and resilient labour market is crucial for sustainable growth; contrary to popular belief, a structurally tight labour market is not inflationary. Continued job creation and upskilling and reskilling initiatives can ensure that individuals have the necessary skills for emerging industries. While the outlook for a soft landing remains possible, several challenges and risks must be considered. These include the ongoing COVID-19 pandemic, potential geopolitical tensions, and unforeseen events that can disrupt the economic recovery. Moreover, the delicate balance between monetary policy and inflation management must be maintained to avoid derailing progress.

An Era of Slow Growth, Declining Inflation, and Interest Rate Cuts

In recent years, the global economy has shifted towards a new era characterized by slow growth, declining inflation, and interest rate cuts. Various factors, including demographic changes, severe debt, technological advancements, and shifts in consumer behaviour, have influenced this shift.

Aging populations in many developed countries led to slower population growth and reduced labour force participation. The result was lower economic growth rates. Technological advancements increased productivity but have also contributed to job displacement and wage stagnation, leading to slower overall economic growth.

Also, changing consumer preferences and behaviours have impacted the inflation landscape. The rise of e-commerce and increased competition have placed downward pressure on prices, making it challenging for businesses to raise prices significantly. The result was declining inflation rates, which central banks responded to by implementing interest rate cuts to stimulate economic activity. How soon do many forget the era of secular stagnation and deflation that was present just a few years ago?

The U.S. Economy’s Strength: Diversity and Innovation

The U.S. economy has several vital factors that position it for potential outperformance into the decade’s end. One significant advantage is its diversified economy compared to Canada. It encompasses many industries, including technology, finance, healthcare, manufacturing, and services. This diversification allows its economy to withstand shocks better and adapt to changing global dynamics.

Additionally, the U.S. holds a leadership position in innovation. The country boasts a robust entrepreneurial ecosystem, a thriving startup culture, and world-renowned technological hubs like Silicon Valley. This innovation-driven environment fosters the development of cutting-edge technologies, creating new industries and driving economic growth. The U.S.’s ability to remain the leader gives it a competitive edge, fuelling its potential for continued success.

Furthermore, the U.S. is a significant commodity exporter, contributing to its economic strength. The country possesses abundant natural resources, including oil, gas, and agricultural products. Its ability to export these commodities to global markets generates revenue and strengthens its position in international trade. The U.S.’s export potential allows it to tap into global demand while expanding its economic reach.

The U.S. Dollar’s Role as the Global Medium of Exchange

The U.S. dollar has long held a dominant position as the medium of exchange for the global economy, and it is difficult to envision it losing this status. Its emergence as a leading commodity-exporting nation, coupled with leadership in innovation, further strengthens its position. This is not the 1970s when the U.S. was beholden to energy imports to drive economic prosperity.

As the U.S. becomes a significant exporter of commodities, such as oil, gas, and agricultural products, its economic influence increases and creates demand for its dollar in international trade. The status of the USD as the primary currency for commodity transactions enhances its global acceptance and reinforces its role as a medium of exchange.

Again, drawing parallels to the post-Second World War period, it is reasonable to consider that the U.S. could maintain its leadership role in the global economy. But it is essential to recognize that it is undergoing significant secular changes, as it does periodically. These changes can introduce new dynamics and challenges that may impact the global currency landscape. Continuous adaptation and vigilance will be essential for the U.S. to sustain its leadership position and the status of the US dollar as the worldwide medium of exchange.

The Influence of Millennials on Social Norms and Investing Preferences

Demographics play a significant role in shaping social norms and investment preferences. Millennials are replacing baby boomers as the critical drivers of these trends. As millennials grow in numbers and influence, their impact on the economy and financial markets becomes more pronounced.

Historical patterns suggest that when a generational cohort’s influence peaks, it often coincides with significant shifts in the market. Like when the baby boomers’ influence peaked in 2000, it is anticipated that the millennials’ influence will also reach its zenith early next decade. This transition could mark the end of the ongoing secular bull market as market dynamics adjust to the changing preferences and behaviours of the new generation.

Millennials are expected to contribute to economic growth and generate good investment returns in their family formation and investing years. Their unique preferences and characteristics differ from those of the baby boomers. Millennials focus more on thematic, top-down investing approaches, use ETFs and Options, prefer Bitcoin to Gold, and are technologically savvy, leveraging digital platforms and tools for investment decisions.

While the past does not exactly repeat itself, similarities and patterns can often be observed. Mark Twain’s famous quote, “History never repeats itself, but it does often rhyme,” highlights this idea. Understanding millennials’ evolving preferences and behaviours can provide insights into potential market trends and investment opportunities. Adapting to the changing landscape and aligning investment strategies with the new generation’s preferences will be crucial for investors to navigate the future effectively.

The Rise of a Secular Bull Market: AI and Blockchain Investments

The global stock market is experiencing a transformative period driven by artificial intelligence (AI) and blockchain technology advancements. These disruptive technologies have the potential to reshape industries, increase efficiency, and create new investment opportunities. As a result, many experts believe that stocks are in the early stages of a secular bull market.

AI has made significant strides in various sectors, including healthcare, finance, and transportation. Its ability to process vast amounts of data and make intelligent decisions has the potential to revolutionize industries, leading to increased productivity and profitability. Similarly, blockchain technology offers decentralized and transparent systems, enhancing the security and efficiency of financial transactions, supply chain management, and digital identity verification.

It is expected that investments in AI and blockchain will drive long-term growth and innovation, making them attractive opportunities for investors. Companies at the forefront of these technologies will likely experience substantial growth, leading to potential stock market gains. As the adoption of AI and blockchain expands across industries, expect the secular bull market to gain momentum.

Implications for Portfolio Allocation: Growth Over Value

Given the anticipated era of slow growth, declining inflation, and interest rate cuts, investors should consider tilting their portfolios towards growth over value. Growth stocks are typically associated with companies that exhibit above average earnings growth rates, often driven by innovative technologies and disruptive business models. These companies are well-positioned to thrive in a slow-growth environment by capturing market share, expanding their customer base, and delivering consistent revenue growth. When comparing significant indexes, one can conclude that the Nasdaq-100 is headed for a period of outperformance. At the same time, the TSX, which has a more value focus, faces significant headwinds.

A Look Into What the Future Holds for Investors

As the global economy enters a new era of slow growth, declining inflation, and interest rate cuts, investors should pay attention to the transformative power of AI and blockchain technologies. These innovations could drive a secular bull market in stocks, presenting attractive investment opportunities. Furthermore, tilting portfolios towards growth stocks can align with the current economic landscape. However, maintaining a diversified portfolio and staying informed about market trends will be essential for successfully navigating the evolving investment landscape.

In late 2022, we held a non-consensus view that bear market lows were reached in mid-October. The S&P 500 level was at 3,550, our target for the S&P 500 was 4,800, and the USA would achieve a soft landing, like in the 1994-95 tightening cycle. What was once controversial is now consensus.

Analyzing historical data dating back to 1928, we find that the average run of a bull market following a bear market low lasted 1,014 days, with stock market returns averaging 114%. By changing the starting point to 1932, we observed that the average bull market lasted five years and yielded an average return of 179%. These findings suggest the possibility of a strong run in the stock market into 2025 and potentially continuing until 2028.

Furthermore, it is worth noting that we anticipate a significant decline in interest rates over the coming years. This expectation is based on the prevailing economic conditions and central bank policies that aim to stimulate economic growth. Generally, lower interest rates positively impact equity markets as they make borrowing cheaper for companies, encourage consumer spending, and increase the attractiveness of stocks compared to fixed-income investments.

However, it is essential to note that historical cycles do not guarantee future performance. The financial market is influenced by various factors, including economic conditions, geopolitical events, and market sentiment, which can significantly impact its trajectory. Therefore, while historical data can provide insights into potential market trends, it is essential to consider other factors and continuously monitor market conditions to make informed investment decisions. That said, it’s always nice to look into the crystal ball occasionally and dream about the future.