Echoes of History and Financial Markets in a Post-Pandemic World

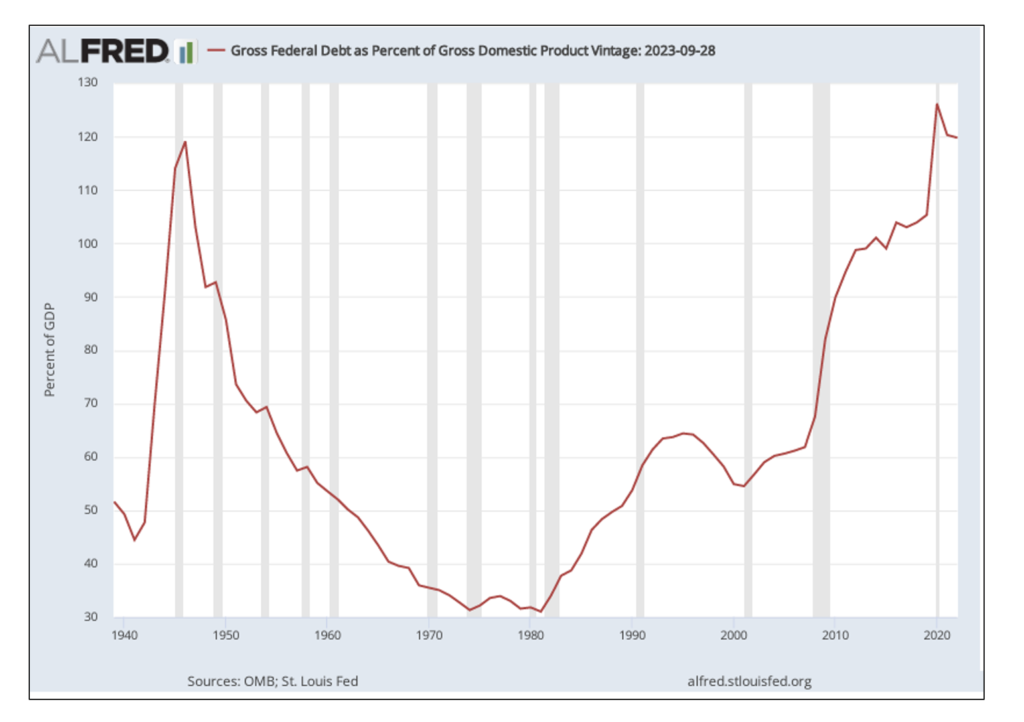

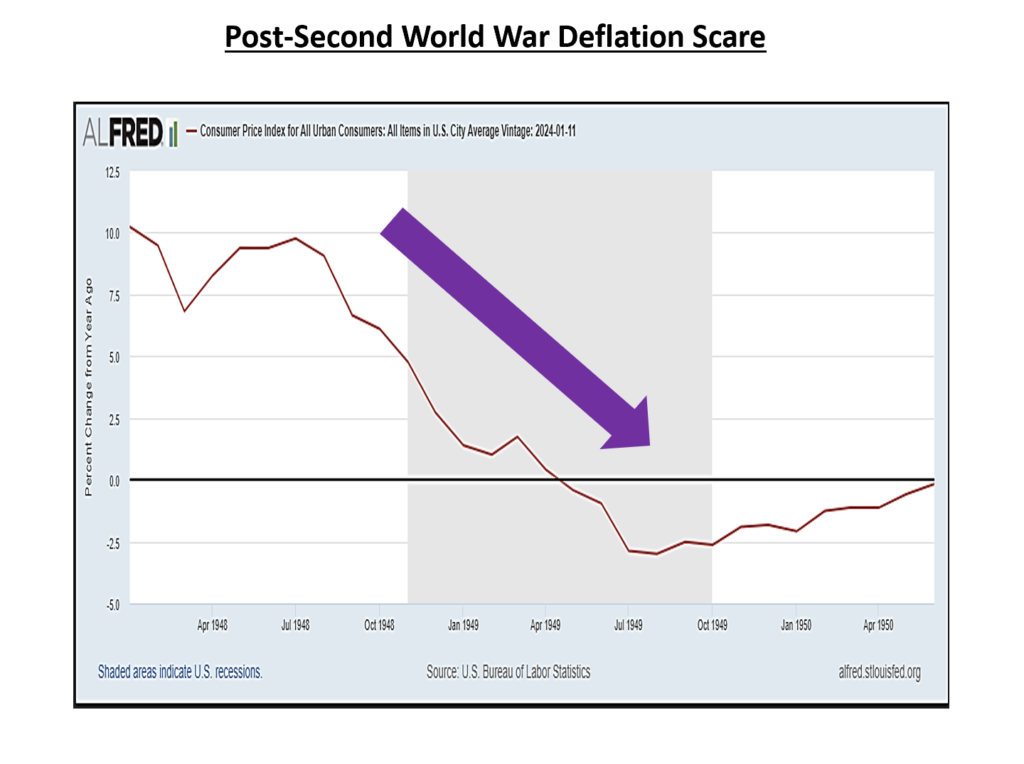

As we enter a presidential election year in the U.S., financial markets are resonating with historical echoes. One can particularly recognize the rise of populism after the Civil War, which parallels today’s socio-political dynamics. This comparison challenges the conventional wisdom about investing in a world that is constantly evolving. Concomitantly, there are parallels to the post-Second World War era, notably the extreme levels of debt which rival only today. As the war ended and life got back to normal, a growth scare and deflation resulted. Hence my thesis that our transition period out of COVID-19 has all the earmarks of a transitional period of secular stagnation and deflation.

The U.S. in the mid-19th century, marked by the Civil War, saw President Abraham Lincoln make significant economic decisions that influenced the nation’s trajectory. His choice to fund the Union’s war efforts by introducing a currency not backed by gold, known as greenbacks, mirrors the U.S. Federal Reserve’s recent monetary policies. In response to the COVID-19 pandemic, the Federal Reserve cut interest rates and implemented measures akin to Lincoln’s, thereby injecting capital into the economy.

Post-Civil War, Lincoln’s recall of greenbacks to contract money supply echoes the Federal Reserve’s quantitative tightening (QT) and subsequent rate hikes following the pandemic, intended to stabilize the economy. Yet, as history shows, both actions resulted in economic downturns, with slowdowns and deflationary periods highlighting the cyclical nature of such interventions. History reveals the global economy is headed for deflation, similar to the post-Civil War and post-Second World War eras.

The economic uncertainty that followed the Civil War also fostered a populist movement, seeking the backing of the U.S. dollar with both gold and silver. This same populist sentiment has resurfaced in modern times, a response to the disenfranchisement and inequality that many feel today.

The Wizard of Oz has often been interpreted as an allegory for the economic and political issues of the late 1800s, particularly the debate over bimetallism.

Bimetallism is a monetary system which allowed for the unrestricted coinage of gold and silver, set at a fixed ratio, to circulate as legal tender. The Yellow Brick Road represents the gold standard, and Dorothy’s silver slippers (changed to ruby in the film adaptation) symbolize the silver standard, as advocated in Former U.S. Secretary of State William Jennings Bryan’s “Cross of Gold” speech. In this speech, he passionately argued for bimetallism, using the metaphor of a gold cross to criticize the strict adherence to the gold standard, which Bryan felt was crucifying the working class and farmers on a “cross of gold.” However, the system was fraught with challenges, such as Gresham’s Law,1 and

became central to the political debate of the 19th century, culminating in the 1896 U.S. presidential election. Today, we find a parallel in central banks who have overtightened, causing hardship for many, and the call for reflation and an end to deflationary risks.

A Global Reflationary Cycle

Looking ahead to 2024-25, a global reflation episode seems imminent, with economic policies and populist measures likely to favour secular growth. Drawing lessons from the period following the 2008 Global Financial Crisis, the NASDAQ-100 and Bitcoin are poised to lead this trend. Nevertheless, as the economy shows signs of bottoming later in 2024, cyclical sectors are expected to catch up, benefiting from the broader economic recovery. To be clear, I’m not forecasting a ‘V’ shaped recovery, my base case is that we are entering a period of secular stagnation and deflation. With debt to gross domestic product (GDP) at levels not seen since the Second World War, investors should anticipate a growth and deflation scare similar to the late 1940s.

Historically, markets have rallied in anticipation of a recovery as the future is discounted. A rally into the summer followed by a correction into the election would not be surprising. If historical patterns are followed, a more substantial rally into the 2026 midterm elections, with an S&P 500 target of 6000, is my forecast. Therefore, investors should consider historical patterns when developing their strategies, with an emphasis on cyclical stocks as recovery signs begin to materialize.

Investment Approaches in a PreRecovery Phase

With the Federal Reserve’s funds rate projected to stay below 2.5% until late 2025, investors have an opportunity to engage in reflation trades. These trades typically align with the populist push for economic growth, indicating that now is a strategic time to invest in sectors that may benefit from lower borrowing costs and economic stimulus. My base case is not a return to the zero bound for interest rates—but to be clear, with extreme levels of debt and a rapid transition into a digital economy, coupled with the two largest economies in the world going through generational structural adjustments, investors need to keep an open mind.

Market Timing and Portfolio Management

As we anticipate the economic bottoming in the latter half of 2024, savvy investors should be prepared to adjust their market entry for cyclical investments. The anticipated rally into the summer offers a window to capitalize on early recovery optimism, per historical trends. However, it is equally important to be vigilant and ready for potential post-election market pullbacks, with an eye toward additional volatility as we approach the 2026 midterm election year. My target for the S&P 500 for 2024 is 5400.

What Should Investors Do?

While the narrative of “this time is different” often appears during unique historical moments, the underlying patterns of history suggest otherwise. The lessons from the postCivil War era, with its economic and political upheavals, provide a valuable framework for understanding today’s market challenges and opportunities.

Principally, they highlight that the dynamics of markets and politics are often cyclical, recuring in patterns that, while not identical, rhyme enough to offer guidance. By recognizing this in economies and markets, and focusing on sectors which benefit from these cycles, investors can craft well-informed strategies that echo successful practices from the past and adapt to the distinct contours of the current era. This balanced approach is key to thriving in the populist era of the mid-2020s. Investors should be alert for the expected reflationary trend and be astute in timing their purchases of growth and cyclical stocks to balance their portfolios.

So, “is this time different?” The answer is a resounding “no.” The patterns of history are manifesting once again, suggesting that insightful investors will benefit from studying the past to prepare for the future.