KEY POINTS

Everyone’s situation is unique.

- Tax is important, but incorporated business owners and professionals should also consider retirement planning, lifestyle and corporate cash flow needs when deciding to take compensation as salary, dividends, or a combination of the two

It can be complicated.

- Canada’s tax system is designed to eliminate any immediate benefit to taking compensation as salary or dividends, but differences in tax rates across provincial and territorial jurisdictions can create an imperfect result.

Advice is valuable.

- The income tax benefits of being paid in salary or dividends may be partly offset by other tax deductions or credits, or additional planning opportunities. It’s advisable to consult a professional tax advisor before deciding.

Incorporated business owners or professionals have considerable flexibility regarding the nature, amount, and timing of their personal compensation. Shareholders who are actively involved in the business/practice can compensate themselves using:

- salary

- dividends; or

- a combination of both salary and dividends.

There is no uniform, one-size-fits-all solution to determine the best option, as a variety of considerations may influence the decision. These generally fall into three main categories: income tax, retirement planning, and other business and personal planning needs.

While not exhaustive, this article examines how these three factors affect the salary vs. dividends discussion and provides some key points to help guide the decision.

1. INCOME TAX

- Salary is an expense/deduction of the corporation and reduces its net income subject to corporate income tax. Salary is a taxable income receipt for an individual and is subject to personal income tax at their respective marginal tax rates.

- Dividends are paid by a corporation with after-tax dollars. They are also a taxable income receipt for an individual and as with salary, subject to personal income tax at their respective marginal tax rates. The tax rates on Canadian dividends for individual taxpayers are effectively much lower than those applied to salary income given that corporate taxes have also been paid. A corporation must pay out more in salary than dividends to achieve the same after-tax income in the hands of the employee/individual shareholder.

Self-employed small business owners and professionals who are not incorporated report net income from their business or practice annually for income tax purposes on their T1 – Income Tax and Benefit Return, whether the funds are needed for lifestyle or not. Generally, self-employed individuals use December 31 as their fiscal year-end and report net income using the accrual basis of reporting.

There are a handful of exceptions allowing non-calendar year fiscal year-end or cash basis of reporting by self-employed individuals, however these are beyond the scope of this communication.

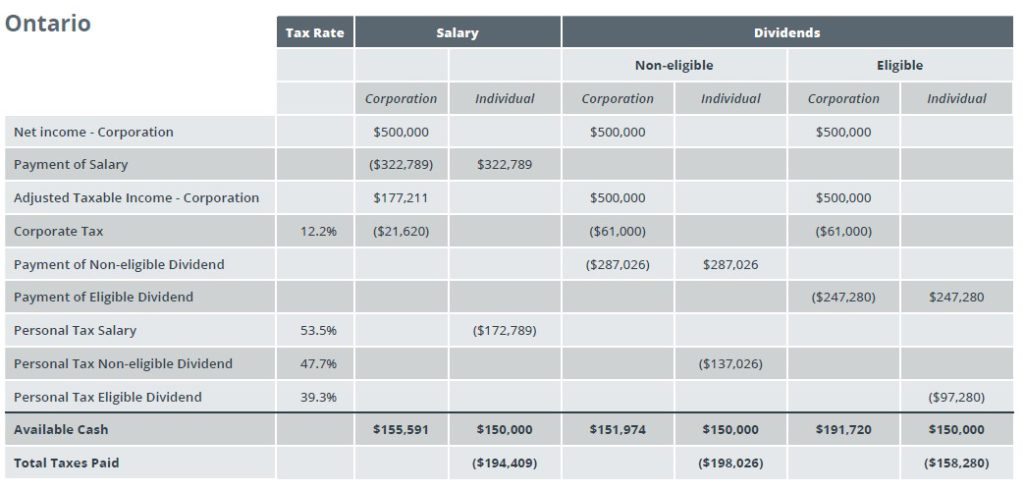

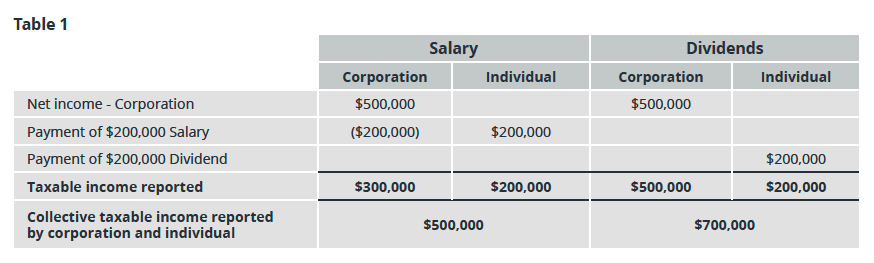

Table 1. below illustrates how the two types of compensation impact the taxable income that would be reported:

Does this mean that paying dividends results in more income reported and tax paid overall?

Yes, but not necessarily, given the concept of “tax integration.” Perfect tax integration eliminates any preference from an income tax perspective of paying salary versus dividends given the respective combined (federal and provincial/territorial) personal and corporate tax rates. Perfect integration puts an individual shareholder in the same position on an after-tax basis, whether they receive a salary or a dividend.

Canada’s Income Tax Act (ITA) has several tools to support tax integration. When considering compensation, the ITA sets out:

I. Different corporate tax rates applied to active business income versus general income; and

II. The gross-up and dividend tax credit regime on corporate dividends paid to individual shareholders.

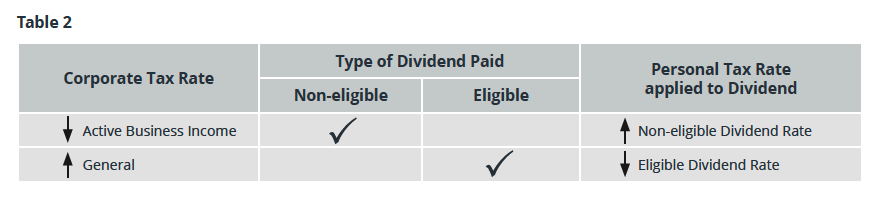

Two corporate tax rates and types of dividends

Canada’s incorporated small businesses and professional practices are generally considered to be Canadian Controlled Private Corporations (CCPCs) that can access the Small Business Deduction (SBD) on active taxable business income up to $500,000,1 thus receiving favourable tax treatment. Public corporations and CCPCs (for income over $500,000) pay higher, general corporate tax rates. Recognizing this difference in corporate tax rates and the impact on after-tax income available to pay dividends, Canada introduced two types of taxable dividends:

- Non-eligible dividends are paid from income taxed at the favourable small business income rates.

- Eligible dividends are paid from corporations taxed at general, or higher, corporate tax rates.

In the hands of an individual shareholder, non-eligible dividends attract a higher personal tax rate than eligible dividends. Table 2 below illustrates how this works:

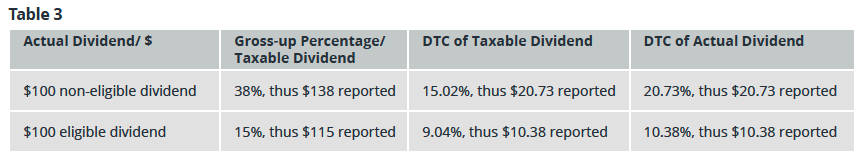

Gross-up and dividend tax credits

The second means to support tax integration is the gross-up and dividend tax credit regime. Dividends received by individual taxpayers are “grossed-up” to reflect the corporate pre-tax income reported. The associated dividend tax credit (DTC) is a credit for the corporate tax paid on this income.

Table 3 below reflects the 2022/23 gross-up and DTC rates on non-eligible and eligible dividends received by individual taxpayers:

While in theory the gross-up and DTC regime should result in perfect integration, this is not always the result in practice. Varying provincial and territorial corporate and personal tax rates generate income tax advantages (deferral of tax, immediate tax savings) and disadvantages (prepayment of tax, immediate tax costs) when evaluating salaries versus dividends across Canada’s provinces and territories.

Simply, if income tax was the only decision driver, it is a matter of determining how much is needed by the employee/shareholder for personal lifestyle needs and choosing the cheapest way to provide that outcome.

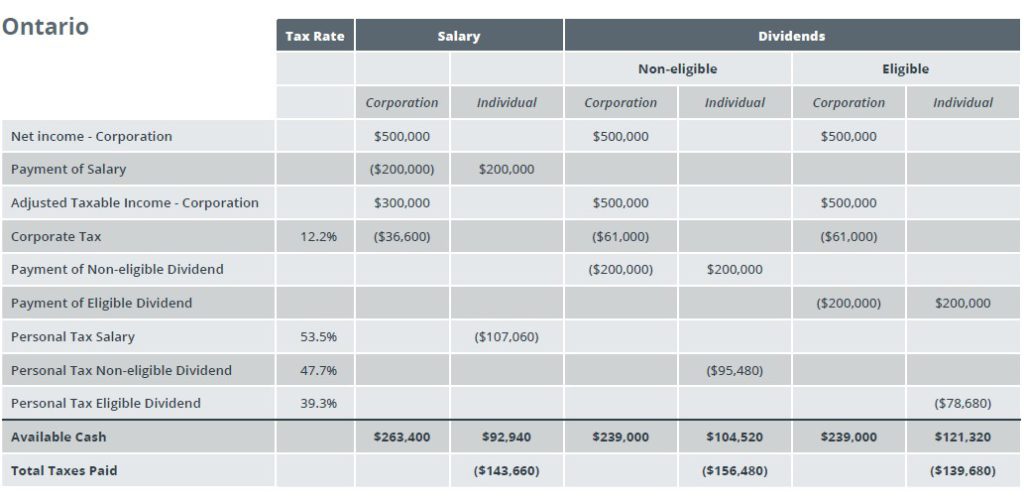

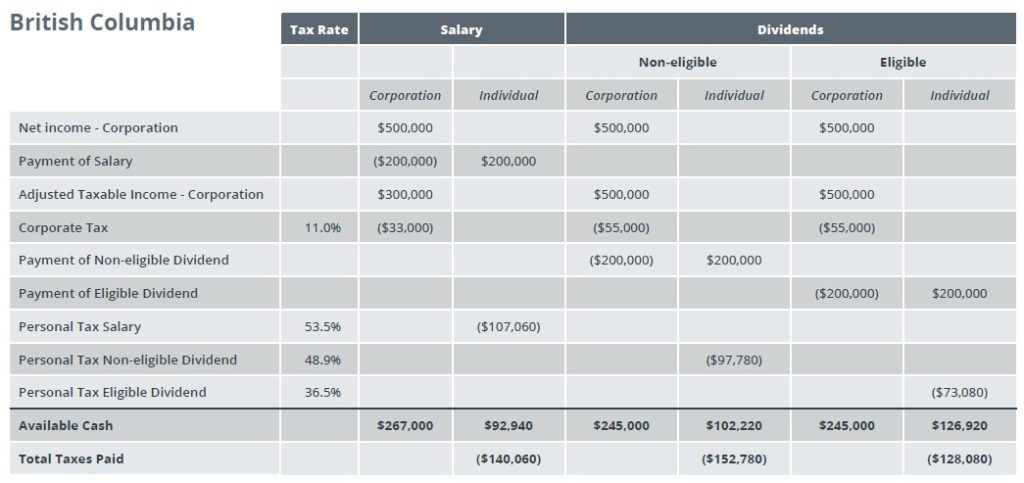

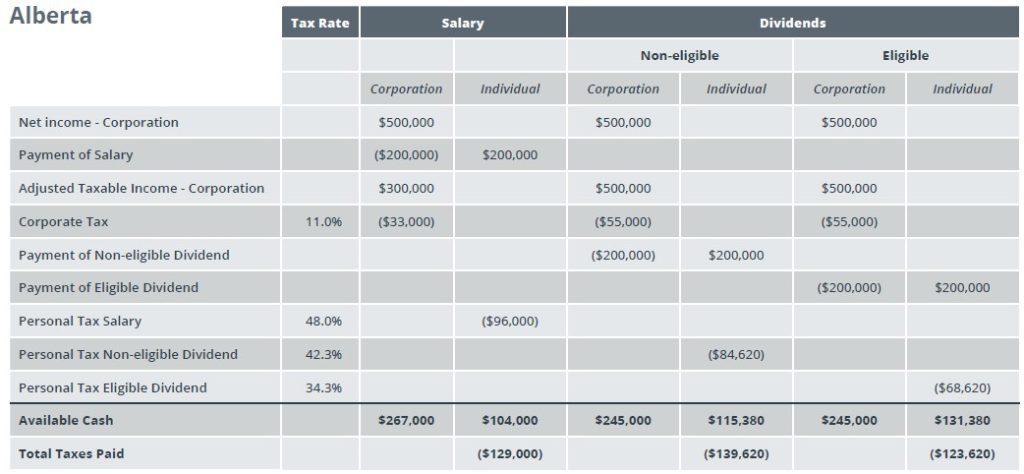

Let’s do a deeper dive to explain. Appendix A reflects the payment of $200,000 in gross compensation, and what is received on an after-tax personal basis, and Appendix B calculates the gross compensation required to receive $150,000 on an after-tax personal basis. Three points are highlighted:

- Total personal and corporate taxes paid.

- The amount the employee/shareholder receives on an after-tax basis; and

- How much is left in the corporation to invest – either to finance business growth or portfolio investments.

In Appendix A, a comparison of $200,000 in salary versus dividend compensation highlights the impact of the different provincial personal and corporate tax rates. Notably:

- The highest tax liability is generated in Ontario when non-eligible dividends are paid, however the employee/shareholder retains more after tax than if salary was paid.

- As Manitoba enjoys a 0% active business provincial corporate tax rate, the highest amount remains in the corporation when salary is paid.

- Alberta, due to its low personal tax rates, generates the highest after-tax cash for the employee/shareholder when eligible dividends are paid.

Appendix B reflects the salary or dividends needed to generate $150,000 on an after-tax basis for the employee/shareholder and highlights the least amount of total taxes paid or highest amount left in the corporation to invest. Again, Alberta’s low personal and corporate tax rates result in the least amount of taxes paid and the highest amount left in the corporation when an eligible dividend is paid to a resident of that province. In fact, residents of Alberta pay the least in taxes and retain the most corporate cash regardless of if they are paid by salary, non-eligible or eligible dividends.

2. RETIREMENT PLANNING

Compensation planning tends to be an annual, short-term focus, but it also impacts longer-term planning considerations such as retirement, and where retirement savings are invested. Here are a few questions to consider:

- Which sources of funding are available to support retirement? Options may include investments in the corporation, savings in a Registered Retirement Savings Plan (RRSP), Registered Retirement Income Fund (RRIF), Tax-Free Savings Account (TFSA), and non-registered investments.

- What is the likelihood of selling the business or practice? Is there an Individual Pension Plan (IPP) in place?

- What if too much cash or passive assets are accruing in the corporation?

Given the many pros and cons to consider when debating salary versus dividends with a focus on retirement income planning, often a hybrid compensation structure is adopted. Here is a brief overview of how the two types of compensation affect retirement planning:

Salary considerations

A salary allows access to the following retirement savings tools:

• An RRSP. Salary is recognized as earned income and generates RRSP contribution room.

- For 2023, RRSP contribution room is calculated as the lesser of: $30,780 ($171,000), or 18% of 2022 earned income.

- When an RRSP is rolled over to a RRIF, RRIF withdrawals provide eligible pension income for income splitting purposes.

• An IPP. Often described as “a super-sized RRSP”, an IPP is a defined benefit pension plan available to individual business owners/key management and professionals who have incorporated. Note:

- The individual must have RRSP contribution room to open an IPP; if no salary is received, the IPP is not available as a retirement planning option.

- An IPP is an asset of the corporation, and it can be problematic if the shares of the business or practice are sold.

• Because dividends are not considered “earned income,” they do not generate RRSP contribution room and are not aligned with IPPs.

• If the CCPC has more taxable income than the $500,000 SBD, paying a salary to reduce taxable income may be suggested, and in tandem with RRSPs/IPPs acts as a deferral and potential tax savings opportunity.

• Canada Pension Plan (CPP). CPP contributions are withheld from salary and a corresponding matching contribution is made by the CCPC as an employer.

- For 2023, the maximum pensionable earnings for CPP are $66,600 and the maximum employer and employee contribution to the plan will be $3,754.45 each.

Many consider $7,508.90 ($3,754.45 * 2) in CPP contributions to be an additional annual expense, but CPP offers many potential benefits in addition to retirement pension benefits. CPP contributions allow access to disability benefits prior to age 65, a death benefit, survivor pension benefits, and disability and death benefits to children of CPP contributors. None of these benefits are available in the case where dividends are the sole form of compensation.

Dividend considerations

• If it’s unlikely that the shares of the business or practice will be sold and excess funds are being retained in the corporation annually during active operations, it may be beneficial to consider paying dividends now, and in the future to fund retirement. This is particularly true in provinces and territories where a tax deferral occurs, as more funds remain invested for the shareholder’s retirement than paid perhaps to CRA.

• A corporation that has ceased active operations is considered a holding company, and dividends are the only means of compensation. In provinces and territories where a tax deferral occurs, the payment of dividends in retirement provides a tax deferral and possible tax savings both in the years of active operations and in funding retirement.

• Dividends provide an opportunity for income splitting. Given Canada’s marginal tax rates, a couple, who are both shareholders, and who are over the age of 64 each reporting $50,000 in Canadian taxable dividends will pay less tax than one spouse reporting $100,000.2 If the spouses are collecting Old Age Security (OAS), paying dividends to support retirement lifestyle needs should be carefully considered given the potential clawback outlined in the next section.

• Paying dividends is also tax preferred over salary compensation where:

- a business owner or professional has maxed out their CPP contributions over the years and is thus entitled to maximum CPP benefits; or

- significant RRSP/RRIF or other pension accounts exist and the business owner or professional is either not planning further contributions or requires additional funds for lifestyle.

3. OTHER BUSINESS AND PERSONAL PLANNING

Personal considerations

• The decision to pay salary or dividends may impact an individual’s entitlement to income-tested tax deductions or credits and social benefits:

- Child Care Expense Deduction.Eligible childcare expenses are an income tax deduction by a single parent, or the parent with lower earned income, such as salary. Where a parent reports no salary and only dividend income, the ability to claim any childcare expenses eligible for deduction would be eliminated.3

- Old Age Security Pension Recovery Tax or “clawback”. This can occur if net income including salary exceeds certain thresholds, or if dividends reflected at their grossed-up/taxable amount put the individual offside. For example, $50,000 of salary will be reflected as $50,000, whereas a $50,000 non-eligible dividend is reflected as $69,000 ($50,000 * 1.38).4

• Income tax is withheld from salary and paid to the Canada Revenue Agency (CRA) regularly throughout the year, resulting in less income tax payable upon an individual filing an annual Income Tax and Benefit Return and minimizing the need to make quarterly tax instalments. Income tax is not withheld on the payment of Canadian dividends, which when regularly reported may trigger the need for individual shareholders to submit quarterly tax instalments.

Corporate considerations

- Salaries paid to a business owner, professional or family member must be reasonable to be considered deductible by the corporation for tax purposes. A general test for reasonableness is whether the same salary would be paid to a non-arm’s length individual for the same contributions and type of work. Dividends are not subject to a reasonability test, but the Tax on Split Income (TOSI) rules must be considered, particularly for family members who are not active in the business.

- Passive income from portfolio investments, such as interest, capital gains, or rental income is taxed at a higher corporate rate, as a portion of the Federal tax is refundable. Canadian eligible and non-eligible dividends are also only assessed Federal Part IV refundable tax. When a CCPC declares and pays taxable dividends to its shareholders, to the extent it has refundable tax balances,5 the refundable tax previously paid will be returned to the business. It is common practice where taxable income is consistent, therefore, to declare and pay taxable dividends as part of the compensation model to clear out refundable tax balance accounts and trigger a dividend refund from CRA.

- Where significant corporate non-capital losses exist, salary generates an additional expense and/or non-capital loss, thus the payment of dividends is favoured if compensation is needed.

CONCLUSION

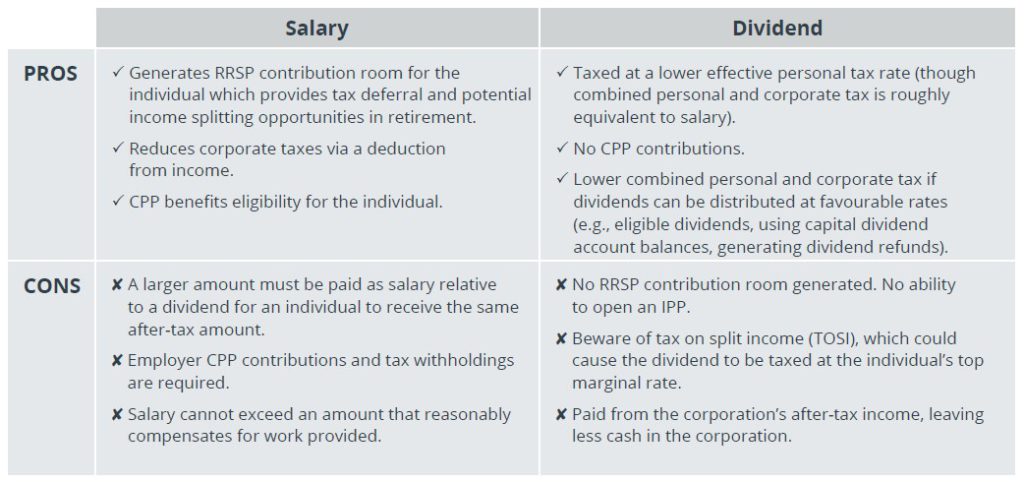

When it comes to the salary and/or dividend compensation discussion, it is not always about tax, as retirement, business and personal planning considerations also come into play. Here’s a table summarizing some of the key advantages and disadvantages of each type of compensation for individuals and their incorporated businesses:

For more information on this topic and to discuss your personal circumstances, please reach out to your Wellington-Altus advisor.

1 Assuming no SBD grind or associated corporations.

2 Where Tax on Split Income (TOSI) is not a consideration.

3 For further information, please see Income Tax Folio S1-F3-C1, Child Care Expense Deduction. https://www.canada.ca/en/revenue-agency/services/tax/technical-information/income-tax/income-tax-folios-index/series-1-individuals/folio-3-family-unit-issues/income-tax-folio-s1-f3-c1-child-care-expense-deduction.html

4 For further information on the OAS Pension Recovery Tax, please see https://www.canada.ca/en/services/benefits/publicpensions/cpp/old-age-security/recovery-tax.html

5 These taxes are referred to as Eligible Refundable Dividend Tax on Hand (ERDTOH) and Non-eligible Refundable Dividend Tax on Hand (NERDTOH).

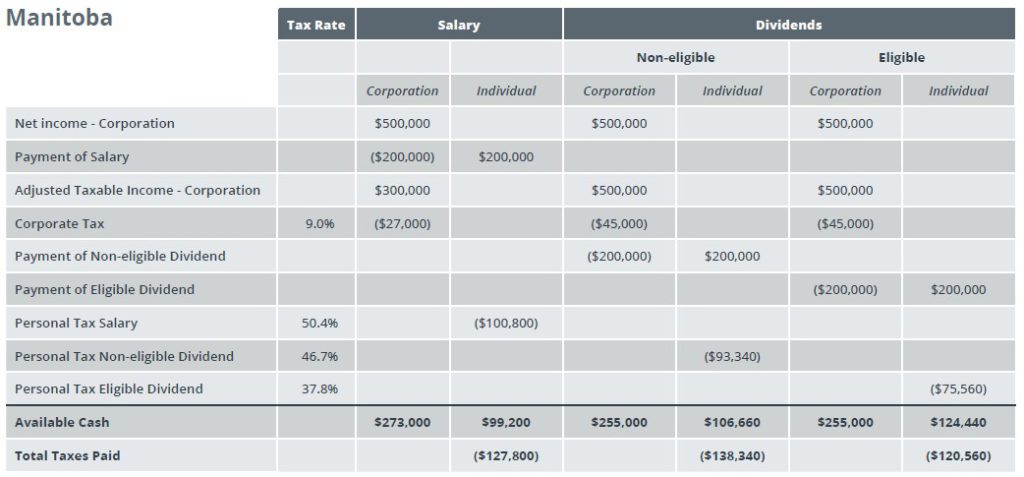

APPENDIX A – PAYMENT OF $200,000 IN COMPENSATION6

6 Active business corporate tax rate and top personal marginal tax rate reflected. While current at the time of publication, tax rates are subject to change. These numbers are approximations for illustrative purposes only.

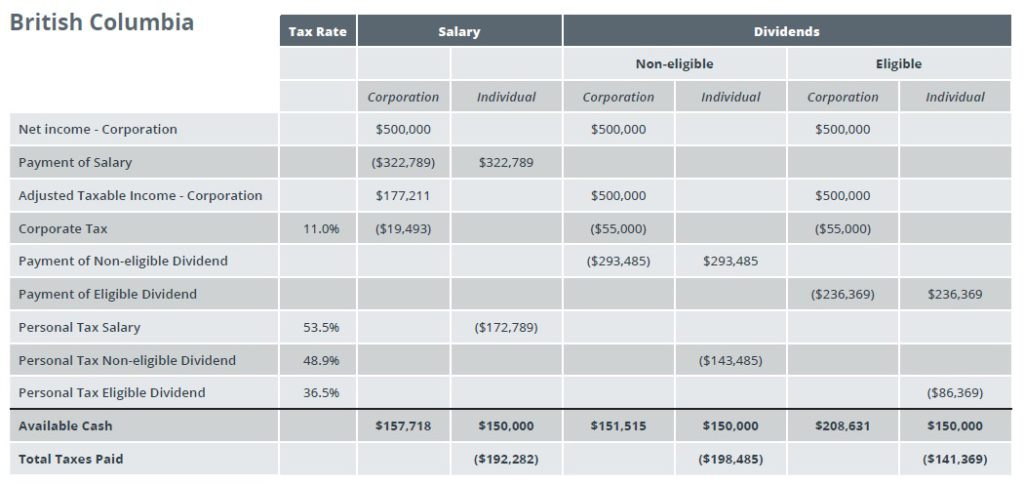

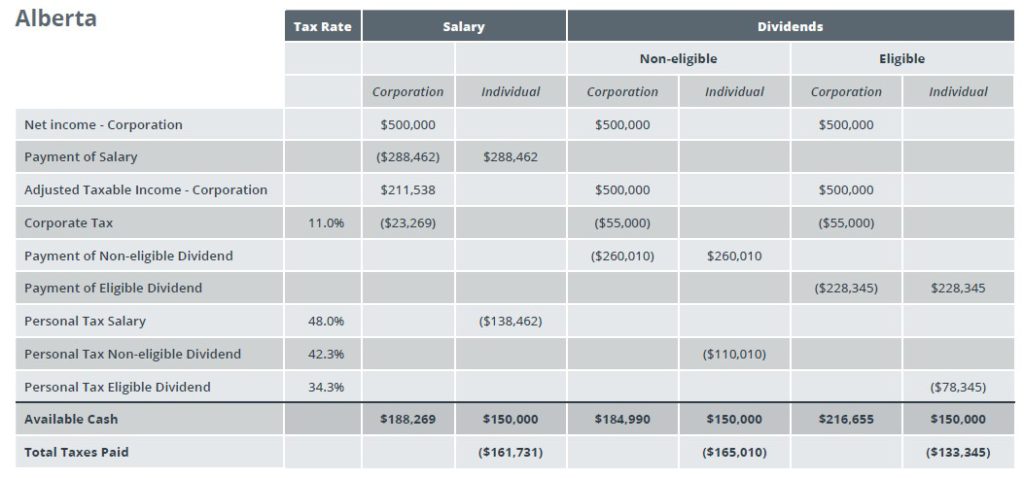

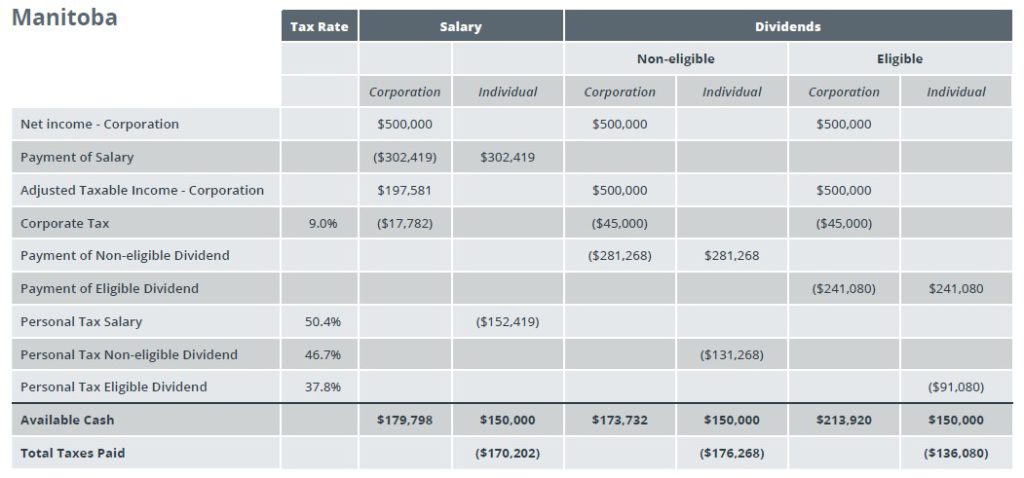

APPENDIX B – $150,000 REQUIRED ON AN AFTER-TAX PERSONAL BASIS7

7 Active business corporate tax rate and top personal marginal tax rate reflected. While current at the time of publication, tax rates are subject to change. These numbers are approximations for illustrative purposes only.